company tax rate 2019 malaysia

Following table will give you an idea about corporate tax computation in Malaysia. Update Company Information.

What Is The Difference Between The Statutory And Effective Tax Rate

10 percent for Sales Tax and 6 percent for Service Tax.

. The maximum rate was 30 and minimum was 24. The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here. Paid-up capital up to RM 25 million or less.

For Sales Tax goods other than petroleum products which are not. Corporate companies are taxed at the rate of 24. Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by 2 percent.

Tax Rate of Company. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Malaysia Residents Income Tax Tables in 2019.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. On the First 20000 Next 15000.

Corporate Tax Rate in Malaysia remained unchanged at 24 in 2021. What supplies are liable to the standard rate. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher.

Company with paid up capital not more than RM25 million On first RM600000. Companies that are about to establish their presence in Malaysia are allowed to apply for 0 to 5 tax rates based on the investments and commitments to job-creation. There will be a two-year stamp duty.

Malaysia Residents Income Tax Tables in 2019. A corporate tax rate of 17 to 24 is imposed upon resident and non-resident companies on taxable income that is sourced from or obtained in Malaysia. On the first RM 600000 chargeable income.

For year of assessment 2022 only a special one-off tax will be imposed on companies excluding companies that enjoy the 17 reduced tax rate above that have. Company with paid up capital more than RM25 million. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

As part of the employers responsibility a company with employees will need to retain a percentage of the employees remuneration including salary commission bonus incentives. Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja. Data published Yearly by.

22 October 2019. Rate TaxRM A. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018.

Malaysia Personal Income Tax Rate. On the First 5000 Next 15000. The Guide to Taxation and Investment in Malaysia 2019 is a bilingual English-Chinese summary of investment and tax information prepared and developed by Deloitte Malaysia.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying. On the First 5000.

Small and medium companies are subject to a 17 tax rate with. What is Corporate Tax Rate in Malaysia.

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Corporate Tax Rates In Asean As Of 31 St Of December 2018 Download High Resolution Scientific Diagram

2020 E Commerce Payments Trends Report Malaysia Country Insights

Singapore Raises Income Tax Rates For Top 5 Per Cent And Malaysia Anilnetto Com

Corporate Tax Rates Around The World Tax Foundation

Italy Government Debt To Gdp 2019 2022 Statista

Comparing Tax Rates Across Asean Asean Business News

Corporate Tax Rates Around The World Tax Foundation

Starting New Business Post October 2019 How Much Tax You Will Save By Forming Company Or Llp Or Partnership

Budget 2019 The Proposed Tax Changes That The Business Must Know Cheng Co Group

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

The Rise Of Phantom Fdi In Global Tax Havens Imf F D

Corporate Tax Rates Around The World Tax Foundation

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

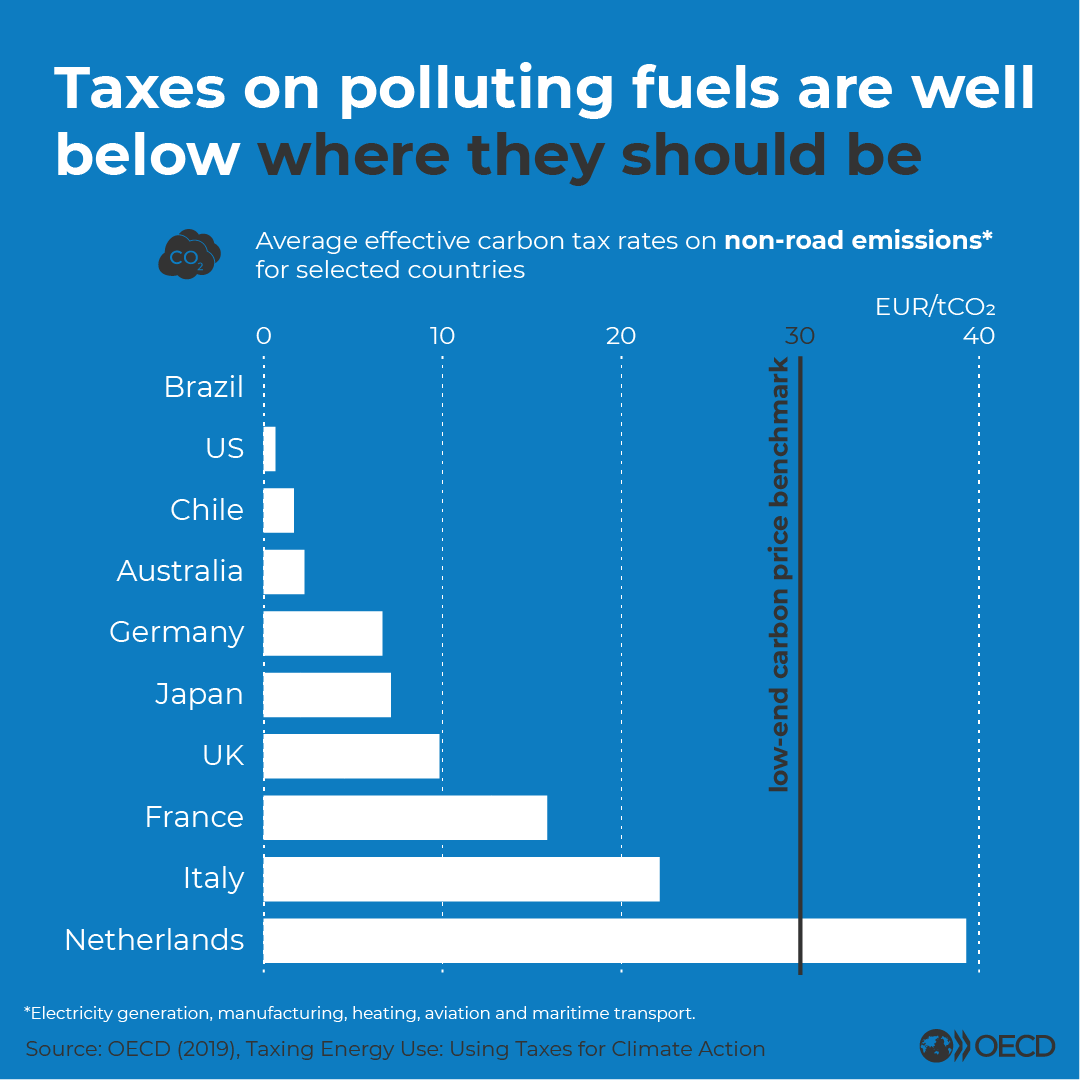

Taxing Energy Use 2019 Using Taxes For Climate Action En Oecd

Payroll Tax What It Is How To Calculate It Bench Accounting

Malaysia Budget 2019 A Boon To First Time Homebuyers And The Affordable Housing Market Re Talk Asia

0 Response to "company tax rate 2019 malaysia"

Post a Comment